Euro government bond opportunities in a rate cutting environment

In Short

"We forecast that the Fed may start cutting rates in May, and where the Fed leads, other central banks will follow"

Mauro VALLE, CFA

Head of Fixed Income and Fund Manager of the GIS Euro Bond range

- Over 25 years of experience

- AAA rated by Citywire2

With inflation decelerating overall and markets pricing in rate cuts for 2024, the environment is ripe for European government bonds to thrive, explains Mauro Valle, Head of Fixed Income at Generali Asset Management.

Decelerating inflation points to rate cuts

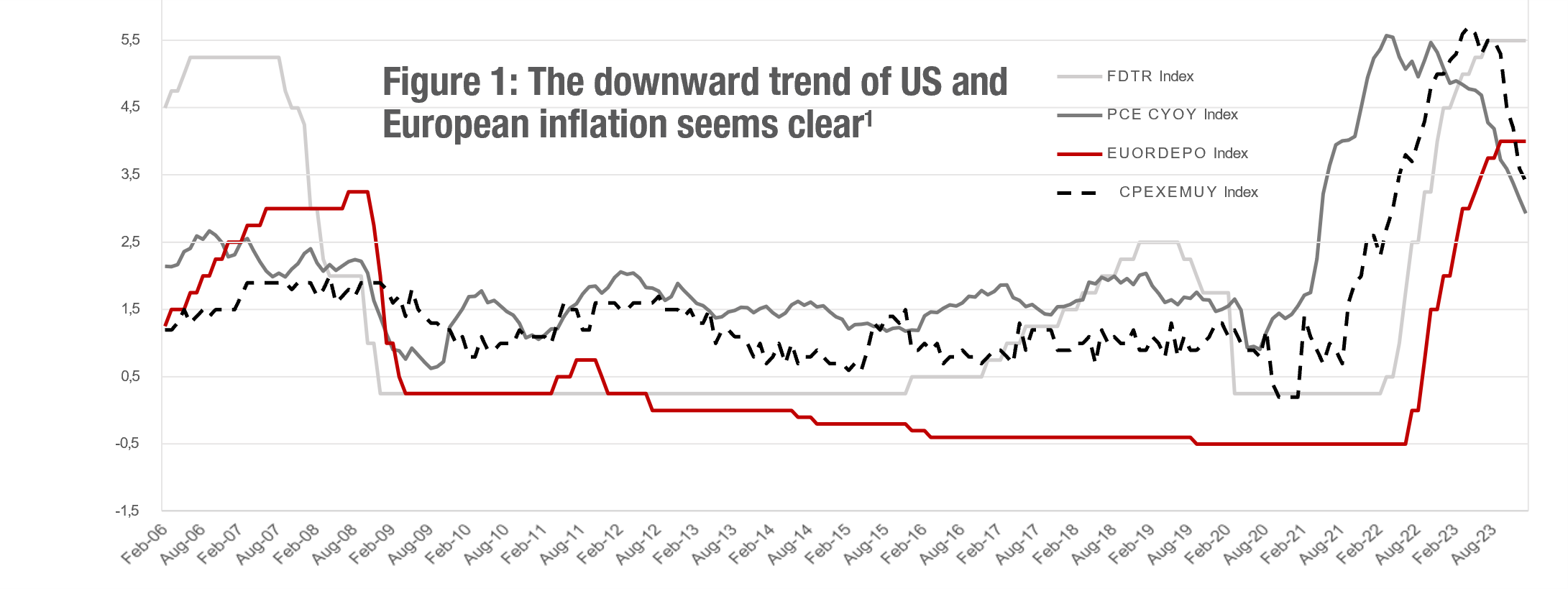

The downward trend of inflation is quite clear, as shown in Figure 1, the main impetus for the Fed and ECB to commence lowering interest rates. That said, the road to lower inflation might not be as linear as the markets had hoped.

The market is fully pricing in a first rate cut from the Fed in June after stronger-than-expected recent US CPI data, increasing the risks for a bumpy road to future inflation declines. Meanwhile, market sentiment is also leaning to a first rate cut from the ECB in June, after its dovish last meeting, with four cuts expected by October.

Both Jerome Powell and Christine Lagarde have tried to temper expectations, and have strongly reiterated that cuts are dependent on further data to confirm inflation and growth trends. Both have pushed back against the likelihood of early rate cuts.

In our view, we forecast that the Fed may start cutting rates in May, and where the Fed leads, other central banks will follow. The ECB might be ready in April if inflation prints continue to decrease, but may prefer to take more time while trends consolidate.

Downward inflation trend is supported by weak euro area growth

This is because we think the downward trend of inflation is not at risk, and that it will continue to decelerate. Despite some signs for better economic growth prospects, there remains disparity between the different EU economies. The eurozone economy remains stagnant overall, with a zero growth posted in the final quarter of 2023 following a 0.1% contraction in Q3, meaning a technical recession was narrowly avoided.

Germany, the biggest economy in the bloc, continues to experience persistent weakness, contracting 0.3% in Q4. In our view, this means that the ECB’s macro forecasts are slightly optimistic, forecasting inflation that is a little too high considering the weakness of the EU. This may provide further support for an accommodative policy stance from the ECB in the coming months. The depth of the rate cuts remain uncertain, and the key variable to monitor is whether the German economy will begin to recover, or whether it will need to lower rates to kickstart growth.

Turning to other members of the “big four” euro economies, France posted zero growth for Q4, while Italy and Spain fared better. Italy, which had been expected to stagnate, recorded growth of 0.2% in Q4, while Spain expanded by 0.6%, three times the 0.2% forecast.

Key Takeways

Although the road to lower inflation will be bumpier than hoped by markets, we think the downward trend is not at risk and that inflation will continue to decelerate.

The weeks ahead could present tactical euro bond opportunities if yields bounce higher, while expectations for a steepening yield curve present opportunities for medium-short maturity bonds.

Government bonds from Italy, Spain and Greece are benefiting from tightening spreads versus Bunds and high investor demand.

Steepening European yield curve opportunities

10-year Bund yields recently rallied from 1.90% in December 2023 to around 2.35% in early February 2024, while the 2-year Bund rebounded to 2.75% after touching 2.35%. We see two key opportunities in this context. Firstly, we are maintaining neutral duration in the Euro Bond portfolios for the coming weeks, in case there are tactical opportunities to add duration if yields see another bounce. Secondly, the current inversion of the Eurozone yield curve reflects market expectations for future rate cuts. When the ECB does signal its intention to ease policy, the yield curve should steepen, with the 2-10 year Eurozone spread widening and a likely outperformance of medium-short maturity bonds.

Staying tactical

In the Euro bond portfolios, we ended 2023 defensively positioned but adjusted this to be tactically neutral in recent weeks, as markets wait for further economic and central bank signals. The portfolios are positioned neutrally on short-term maturities and slightly longer on aggregate compared to the benchmark, defensively short on the 30-year maturity, and long on peripheral bond exposure, particularly Italian BTPs.

Peripheral bonds are flourishing

Spreads on the 10-year BTP-Bund have tightened in the last few weeks, reaching around 150 bps at the end of January, the lowest in the last two years. This was thanks to various factors including the confirmation of Italy’s neutral outlook by rating agencies, higher-than-expected GDP growth, and expectations that future fiscal debts will be limited by the EU Stability and Growth Pact. We therefore confirm our positive stance on Italian BTPs to which we are overweight versus the benchmark. The key risk is high net issuance expected in the coming weeks, however given strong demand we do not think this will materially impact spreads for now.

We continue to be positive on peripheral government bonds from Spain and Greece, both of which have seen 10-year spreads against Bunds tighten. Their latest bond syndications both showed huge demand, as investor appetite for carry and yield continues.

In short, given the favourable outlook, we think investors should exploit current elevated interest rates to optimise returns ahead of rate cuts, while adding duration for diversification in the event of a risk-off environment or increased volatility.

"When the ECB does signal its intention to ease policy, the yield curve should steepen"

#4

ECB rate cuts expected by October 2024

c.150bps

10-year BTP-Bund spreads

1Source: Bloomberg as at the 29th January 2024. 2The investment team is subject to change. Source of award Citywire. A rating is drawn for illustration only and is subject to change. For more information about the rating (methodology, universe taken) please refer to the following link: https://citywire.com/americas/manager/mauro-valle/d5145.

***